Decarbonising the Value Chain and Mastering Scope 2 & 3

The global race to Net Zero has fundamentally changed the landscape of corporate operations.

For businesses today, sustainability is no longer a general concern, it is a core driver of resilience, competitiveness, and long-term financial viability. The pressure from regulators, investors, and consumers is mounting, all guided by the framework of Environmental, Social, and Governance (ESG) criteria. Within this framework, a company’s performance is increasingly defined by its ability to manage and reduce its entire carbon footprint, placing a critical focus on Scope 2 and Scope 3 emissions.

For companies seeking tangible, visible, and financially shrewd decarbonisation options, the choice is clear: investment in solar panels is not just an environmental action; it is a strategic economic imperative.

Understanding the Three Scopes: The Carbon Footprint Map

To truly understand the power of solar investment, we must first define the emissions landscape: the three scopes of the Greenhouse Gas (GHG) Protocol.

-

Scope 1: Direct Emissions. These are emissions from sources owned or controlled by the company, such as company-owned vehicles or on-site combustion in boilers.

-

Scope 2: Indirect Emissions from Purchased Energy. This category covers the emissions generated off-site from the production of electricity, steam, heating, or cooling that a company purchases and consumes. For most businesses, purchased electricity is the primary source.

-

Scope 3: All Other Indirect Emissions (Value Chain Emissions). This is often the largest and most complex category, encompassing everything that happens upstream and downstream in the company’s value chain. This includes emissions from purchased goods and services, business travel, employee commuting, waste disposal, and the use and disposal of sold products. For many firms, Scope 3 accounts for upwards of 70-90% of their total carbon footprint.

While Scope 1 is generally manageable through fleet electrification or fuel switching, the real challenge, and the real opportunity for a transformative impact, lies in addressing the indirect emissions of Scope 2 and, more crucially, the sprawling complexity of Scope 3.

Crushing Scope 2 Emissions

The most direct and immediate impact of installing a commercial solar PV system is the drastic reduction of Scope 2 emissions.

When a business purchases electricity from the national grid, that electricity carries a carbon factor derived from the fuel mix (gas, coal, nuclear, renewables) used to generate it. This purchased energy is the definition of a Scope 2 emission.

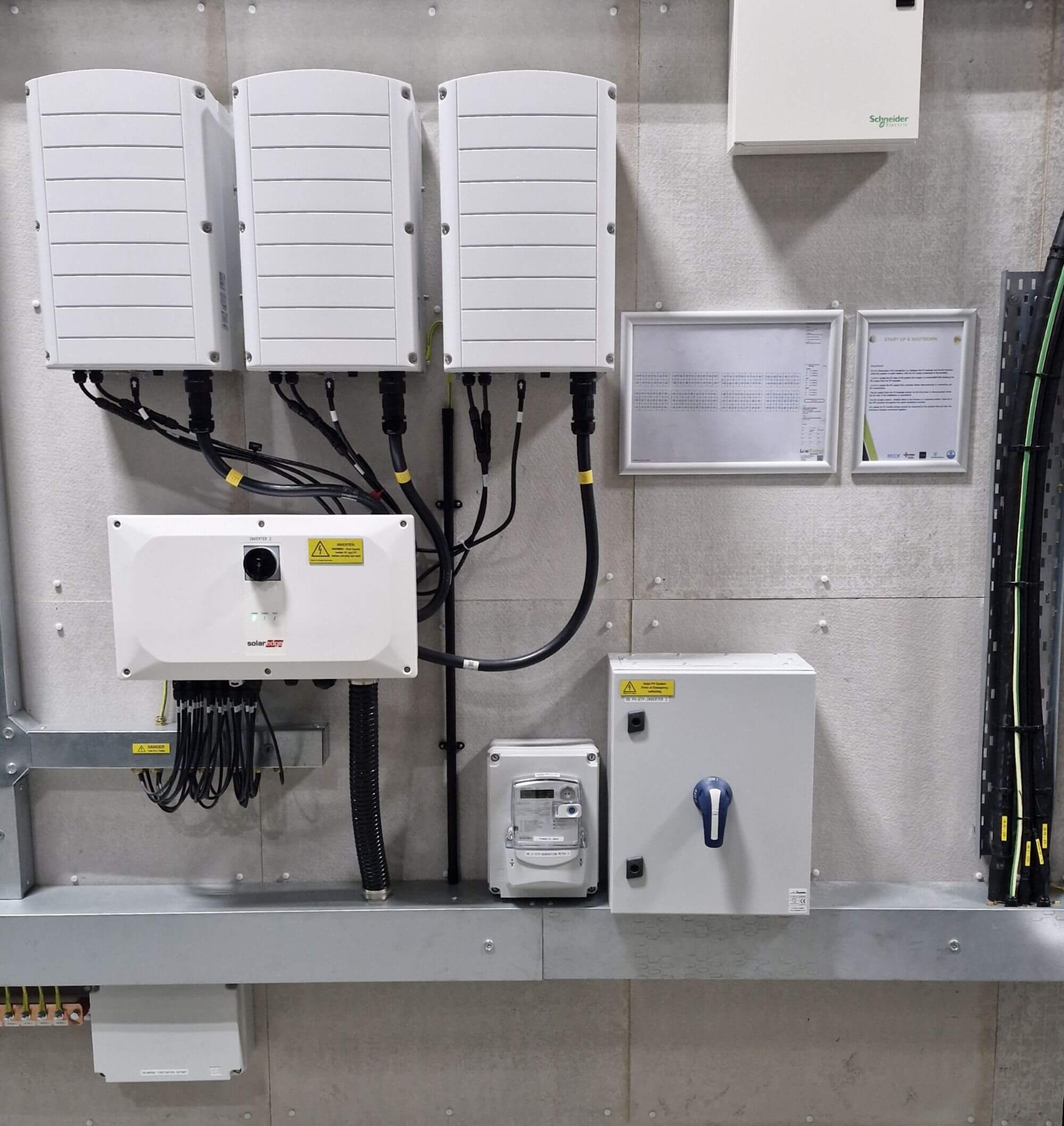

By installing on-site solar panels, whether on a large factory rooftop or a company’s ground-mounted array, the business generates its own clean, renewable energy. This clean power directly displaces an equivalent amount of grid electricity.

This change is not theoretical; it is immediately quantifiable. Every kilowatt-hour generated by the solar array is carbon-free energy consumed by the business, delivering a verifiable, substantial, and permanent reduction in Scope 2 emissions.

The Financial and Resilience Upside

Beyond the environmental mandate, this shift provides profound business benefits:

-

Financial Savings and ROI: By self-generating electricity, businesses significantly reduce their reliance on utility providers and hedge against energy market volatility and future price hikes. A well-designed commercial solar system offers a compelling Return on Investment (ROI), with typical payback periods that are shortening year by year.

-

Energy Independence: Paired with integrated battery storage solutions, solar PV systems offer enhanced energy resilience. Storage allows a business to use its self-generated power after sunset or during grid outages, ensuring operational stability—a key factor under the ‘S’ (Social) and ‘G’ (Governance) of ESG.

Solar’s Strategic Impact on Scope 3

While solar directly tackles Scope 2, its strategic value truly shines in its ability to influence the colossal challenge of Scope 3 emissions.

Reducing Scope 3 is a supply chain decarbonisation effort, requiring collaboration and setting a clear expectation for low-carbon operations across the entire value chain. A business’s operational footprint is its customer’s upstream Scope 3, and its supplier’s operational footprint is its own purchased goods and services (another Scope 3 category).

Driving Upstream and Downstream Decarbonisation

-

Upstream Influence (Purchased Goods and Services): By demonstrably committing to on-site solar, a company signals to its suppliers that low-carbon energy is a purchasing priority. This creates a market pull, encouraging suppliers to invest in their own renewable energy solutions to remain competitive. A supplier with a lower Scope 2 (thanks to solar) directly helps lower their customer’s Scope 3 emissions.

-

Downstream Influence (Use of Sold Products): For manufacturers of products that require energy to operate (e.g. electronic goods, equipment), investing in solar demonstrates a holistic commitment to sustainability. More visibly, for businesses installing Electric Vehicle (EV) charging points, a solar array provides the ultimate decarbonisation story: cars charged with 100% clean, on-site electricity. This visibly enhances the ESG reporting profile of the business and makes its product offerings more attractive to climate-conscious buyers.

-

Enhanced Brand Reputation and Tenders: In a world where ESG performance is increasingly factored into tender weightings and contract awards, visible solar investment acts as a powerful, non-greenwashing statement. It is a live, verifiable declaration of a company’s commitment to a low-carbon economy, significantly improving its brand reputation and making it a preferred partner for larger clients who are aggressively managing their own Scope 3 footprint.

Solar: The Cornerstone of an ESG-Driven Strategy

The move towards decarbonisation is driven by more than simple altruism; it is a critical response to market demand. Investors, led by frameworks like the Task Force on Climate-related Financial Disclosures (TCFD), demand transparent climate risk management. Solar panels are a tangible, auditable asset that provides the data necessary for robust ESG reporting and regulatory compliance.

The investment in solar addresses key areas across the ESG spectrum:

-

Environmental (E): Direct reduction of Scope 2 emissions and encouraging Scope 3 reduction across the supply chain.

-

Social (S): Contributing to energy resilience and stability, which benefits communities and maintains operational continuity.

-

Governance (G): Demonstrating forward-thinking risk management by hedging against energy price volatility and complying with evolving climate regulations.

Future-Proofing the Business

The UK’s target for Net Zero by 2050 means that the cost of carbon will only increase, either through direct pricing mechanisms or tighter regulatory control. Businesses that delay the transition to clean, self-generated energy will inevitably face higher operational costs and significant competitive disadvantages.

Investing in solar is the single most effective action a business can take today to lock in lower operating costs for the next two decades while simultaneously achieving immediate, measurable progress against their most challenging emissions categories: Scope 2 and Scope 3. It is a strategic step that transforms a business from a passive energy consumer into an active player in the green energy transition, a move that is essential for both the planet and the new bottom line.

Renewable Energy Specialists

Renewable Energy Specialists